2022-11-04

Now, before you prepare to export your goods from China to Mexico, it is important to consider the following factors.

- Customs regulations in both countries

- Each country's import and export policies and restrictions

- Shipping documents

- The shipping method applicable to the goods

- Appropriate transportation routes to be used for the chosen mode of transport

To be sure, you may have problems when your shipment reaches the Mexican border before entering or leaving the country.

Make sure you understand the current regulations and restrictions on exporting from China to Mexico. You do need an expert to help you with customs brokerage documentation, clarify case-by-case requirements, and provide critical visibility into the trade process to avoid costly delays. This is also the time for you to know what documents you need to prepare for your goods to pass through customs smoothly.

The basic Mexican import document is the customs declaration form used for customs clearance. Mexico requires import and export documentation, including a completed pedimento for all commercial border crossings.

This documentation must be accompanied by a commercial invoice (in Spanish), a bill of lading, a packing list and a certificate of origin. In addition, if applicable, there are documents proving the guarantee of the payment of additional duties on undervalued goods, and documents proving compliance with Mexican product safety and performance regulations (see Trading Standards section).

| JIKEship NOTE |

|---|

| 1)The commercial invoice must list the value of the goods, the HS tariff classification of the goods, and the country of origin of the goods. |

| 2)The packing list must show the quantity and type of each item, the HS tariff classification of the goods, and the gross and net weight of the goods. |

| 3)The bill of lading must specify the name and address of the shipper and consignee, the port of loading and unloading, the description and quantity of the goods, and the date of shipment. |

| 4)The certificate of origin must be issued by the chamber of commerce of the exporting country and must list the HS tariff classification of the goods, the country of origin of the goods, and the date of export. |

The Customs threshold (from which tariffs are required) is duty and VAT on products valued up to $50.

All USMCA-compliant products “definitively” imported into Mexico are no longer assessed the customs processing fee (CPF). Products temporarily imported for processing and re-export may be subject to the CPF because the imports are not considered “definitive.”

The import duty, if applicable, is calculated on the U.S. factory value (FOB price) of the product, plus the inland U.S. freight charges to the border and any other costs listed separately on the invoice and paid by the importer. These may include charges such as export packaging, inland freight cost, and insurance.

In addition, Mexico imposes a value-added tax (IVA) on most sales transactions, including the sales of foreign products. The IVA rate is 16 percent for all of Mexico. Basic products, such as food and medicine, and some services, are exempt from the IVA.

A special tax on production and services (IEPS) is levied on the imports of alcoholic beverages, cigarettes and cigars, soda pops, energy drinks, high-calorie foods, junk foods and fuels. This tax may vary from 25% to 160 %, depending on the product.

Tariffs, duties and taxes are something that all importers are familiar with. These government expenses are calculated using specific and regulated methods.

Step 1: Determine the duty percentage rate on the cargoes you’re shipping.

This rate varies depending on the destination country. To find the duty rate, visit the Mexico Customs and Border Protection website’s trade tariff page. Duty rates can be found by using an HS code or product description.

Step 2: Calculate the duty on your shipment.

Once you have the rate, you can calculate the amount of duty on the shipment. Add up the value of the shipment, freight costs, insurance and any additional costs, and multiply the total by the duty rate. The result is the amount of duty you’ll have to pay Customs for your shipment.

Total Duty Amount = (Value of Goods + Freight Cost + Cost of Insurance + Additional Costs) * Duty Rate

Want to learn more? More information can be found in "How are import duties and taxes calculated?".

All in all, once your shipment arrives at the Mexican customs broker's facility, it should take 48 to 72 hours to successfully pass through customs. This time will be used to do all necessary equipment and shipment checks, process the proper paperwork and receive payment of duties, taxes, and fees.

NOTE:2 Ways to Make Your Process as Smooth as Possible:

Each country has its own list of banned items. Mexico is no exception and we have listed below some of the main items that are banned.

The following items are prohibited or restricted:

A complete list of these items and their HS codes can be found on the Prohibited Items List at the Mexican Customs rules website.

If you have any questions, please contact JIKEship Mexican Customs Brokers in time, we’re always happy to help you in any way you need.

With our years in the freight forwarding from China to Mexico, we not only have expert knowledge about the best freight routes and methods of shipping freight, but it also given us key relationships with carriers. This allows us to offer the cheapest way of shipping to Mexico and to ensure space availability when shipping cargo.

Sea freight is the most common way to transport items from China to Mexico, mainly because of its versatility and reliability. Everything can be shipped by sea, including very large and heavy items (e.g. cars).

Our sea freight service from China to Mexico covers all the major ports: Shanghai, Shenzhen, Ningbo, Qingdao, Guangzhou, Tianjin, Dalian, Xiamen, Hong-Kong and Macao. We provide door-to-door, door-to-port, and port-to-port shipping services from China to Mexico according to your specific needs.

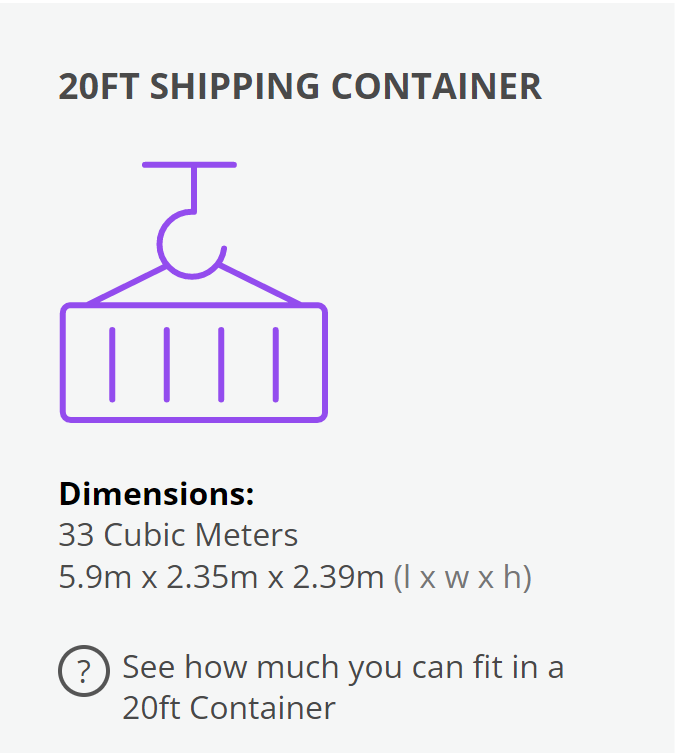

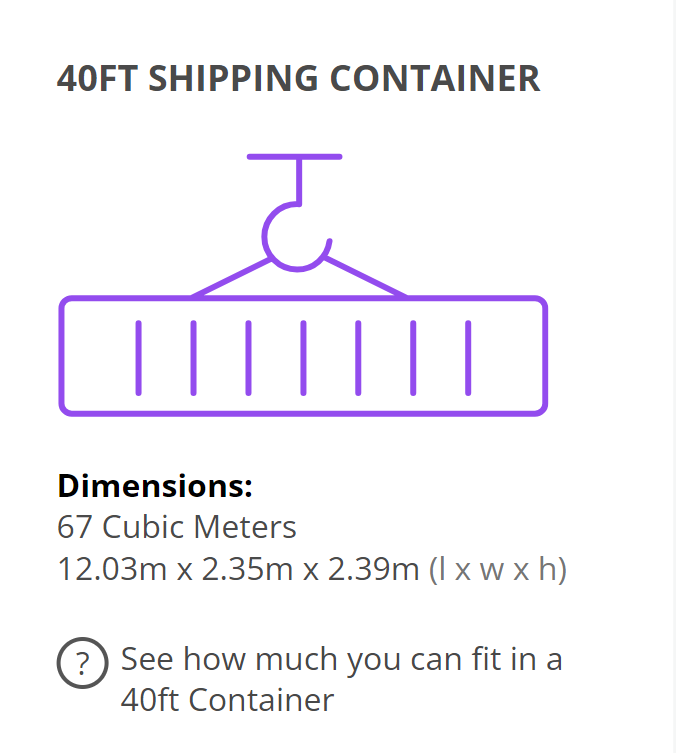

In terms of size, there are three types of cube containers: 20ft, 40ft, and 40ft high.

A standard 40ft container can hold 22 standard pallets, with a 20ft container holding 10 pallets.

| 20ft | 40ft |

|---|---|

|

|

If you’re transporting large volumes and can fill a container, it makes sense to choose FCL (Full Container Load). The other advantage of a Full container load is that your items are stored separately from other importers.

If you do not have enough cargo to fill a 20ft or 40ft container (FCL), you should use an LCL container. This means combining your cargo with other shipments to the same destination.

Our ocean consolidation service from China to Mexico is always available. When using this service, the applicable rates are based on the volume of the shipment. If the weight of the shipment exceeds the maximum weight allowed per cubic meter, then the applicable rate is based on the weight.

FCL is cheaper than LCL because instead of paying for each C.B.M (cubic meter), you to pay for each container. The entire shipment belongs to one customer, and it has a customs license. The review is for one case only.

You may be wondering why someone would choose LCL if FCL is the cheaper option. With FCL, you pay for the entire container. If your shipment is too small to fill the container, it can be more cost-effective to opt for LCL, where you’re only paying for the space your items take up.

The biggest advantage of air freight is its speed. Items leaving China can arrive in Mexico in 5-7 days. This is the best option for high-value items, as they take less time in transit.

Keep in mind that airfreight usually only involves shipping the cargo to the airport in Mexico, not to the final destination of the inventory. Additional shipping accommodations must be made to get your shipment to its final destination.

JIKEship has developed a vast network of carriers that specialize in air cargo transportation, offering daily and weekly departures from China’s main airports to any air destination around the globe.

Our shipping options include airport-to-airport, door-to-door, airport-to-door, and door-to-airport services, among others.

This could vary in times when there is a high volume of cargo moving due to higher demand in the market. JIKEship can provide expert knowledge to your logistical needs in this respect.

The charter service allows you to handle the export of cargo shipping to Mexico with peace of mind. The types of cargoes transported by this service are:

NOTE:Our part charter and full charter options range from 10.000 lbs (5.000 kgs) to 45.000 lbs (22.000 kgs) and can be loaded on pallets, skids, crates or simply in bulk.

Port congestion, customs delays, and weather conditions may increase the time it takes to deliver goods from China to Mexico.

Please see an example of transit times to Mexico:

| Express | 3-5 Days |

|---|---|

| Air Freight | 5-7 Days |

| Sea Freight | 18-30 Days |

This is the fastest option for shipping goods to Mexico. With express shipping, your goods can reach their destination within 3-5 business days.

A variety of well-known carriers provide these services, such as UPS, TNT, FedEx, and EMS. They all have an excellent reputation for reliability, so you can rest assured knowing that your items are arriving at their destination quickly.

The declared value of goods shipped to Mexico is greater than or equal to $1000, and a certificate of origin CO is required.

FedEx takes electronic products to the U.S. and Puerto Rico, which needs to provide FCC forms, and Mexico needs to provide tax numbers. If these four countries/regions do not have a company name, a non-company address fee will be charged.

Mexican customs regulations state that any footwear goods, regardless of the value or quantity, cannot be imported into the local area, including samples, gifts, personal items, online shopping, and other footwear items.

Incoterms play an important role in international shipping. If you have never transported anything internationally before, you may not be familiar with the term "Incoterms".

They are the industry standard, so it's important to be familiar with them. Knowing the correct Incoterms to use will help you save a lot of money when importing from China to Mexico. Make sure you are familiar with these Incoterms and define the shipping Incoterms before moving forward.

You need to know that here, the seller is responsible for providing the goods available at the seller's premises.

It is worth noting that the buyer bears the entire risk from there to the destination.

The seller is responsible for delivery of cargoes loaded on board the ship.

The risk is transferred as soon as cargoes have been set down inside the ship.

The seller bears the insurance and freight costs, and unpaid duties, to the named port of destination.

Once the cargo has been set down inside the ship, the risk is transferred.

The seller is responsible for bringing cargoes to the destination, paying any duty and making the cargoes available to the buyer.

The risk transfers as soon as the buyer has access to cargoes ready for unloading at agreed destination.

| How much is customs duty when shipping to Mexico? |

|---|

| The amount of customs duty you will be required to pay when shipping to Mexico depends on the items you are sending, their declared value and the regulation of each country. When arriving in the destination, the shipment will have to go through the customs clearance procedure, where the authorities will check its content and attached documents to determine the cost of the customs duty, if applicable. The customs fees must be paid by the receiver directly to the selected logistics provider. |

| What is the duty free allowance for Mexico? |

|---|

| 10 packs of cigarettes or 25 cigars or 200g of tobacco. 3L of spirits and 6L of wine. Other goods to the value of US$500 (if arriving by air) or US$300 (if arriving by land). Mexican nationals may bring goods to the value of US$500 if arriving by land during holiday periods such as Easter week. |

If you want to begin your business journey, but aren’t sure what to do next, then please send up a message.

We are happy to help you and teach you the fundamentals and the details when it comes to importing, because our success is directly linked to your success.

We use third-party cookies in order to personalise your experience.

Read our cookie policy