2023-04-24

As a global freight forwarder, we are well aware of the difficulties and dangers associated with shipping cargo across borders. As a result, we strongly advise you to buy international cargo insurance when shipping your cargo. We will go into great detail about the types, benefits, and purchasing procedures for international cargo transportation insurance in this article.

International cargo transportation insurance is a type of commercial insurance in which the underwriter pays benefits in the event that cargoes are lost, damaged, or stolen while being transported from one location to another. Due to the unique characteristics of cargo transportation, which include numerous risk factors like long distances, long transportation times, transit of various means of transportation, weather changes, etc., cargo transportation insurance is crucial when shipping goods internationally.

Whether it is related to natural disasters such as lightning, tsunami and earthquake, accidents such as ship grounding, collision and sinking, as well as external dangerous accidents such as fire, theft, breakage and vicious behavior of personnel on board, it shall be covered by import and export cargo transportation insurance provided by Jike logistics; The geographical scope of transportation insurance covers the whole world; Provide full insurance for import and export business of sea, land, air, railway and express with low deductible.

The following insurance categories are typical classifications for international cargo transportation:

In international trade, CIF insurance is a typical type of insurance. Cargo, insurance premiums, and freight are all covered by cif insurance. In this type of insurance, the seller is responsible for covering the price of insurance as well as the risk associated with transporting the products from the port of origin to the port of destination. The buyer is not required to acquire additional transportation insurance in this instance.

In international trade, FOB insurance is a popular type of insurance that solely covers the expenses of the goods and insurance; the buyer is responsible for the freight costs. In this type of insurance, the seller just needs to acquire coverage for the items; additional transportation insurance must be purchased by the buyer.

The most comprehensive type of cargo transportation insurance is known as "all-risk," and it covers risks such as theft, natural disasters, war, and transportation-related dangers. Cargo owners can obtain full insurance protection with all-risk insurance.

By choosing the extent of the cargo loss risk that has to be insured against the risk of loss, damage, or loss of cargo, etc., cargo owners can choose partial insurance.

Insured amount = CIF price × (1 + insurance bonus rate)

Premium = Sum insured × rate

Since the calculation of the insurance amount is based on the CIF (or CIP) price, if the CFR (or CPT) price needs to be changed to the CIF (CIP) price when making an external quotation, or when the buyer requests the seller to insure on behalf of the seller under the CFR (or CPT) contract, the CFR (or CPT) price should not be directly calculated based on the CFR price, but should be converted into the CIF (or CIP) price before the corresponding insurance amount and insurance premium are calculated.

(1) When importing by CIF: Insured amount = CIF price× (1 + insurance bonus rate)

(2) When importing according to CFR: the insurance amount = CFR price×1.1 / (1 - (1 + insurance bonus rate) × r), where r is the insurance rate, please find it in the relevant website of the "insurance company" in My City (city center), and add the insurance rate of the insurance object invested.

(3) When importing by FOB: insured amount = (FOB freight + sea freight) ×1.1 / (1 - (1 + insurance bonus rate) × r).

Note: According to the regulations of insurance companies, war insurance and strike insurance, if the insurance is added at the same time, the rate is not cumulative, and it is still calculated according to the rate of only one of the insurance types. That is, regardless of whether only one or both of them are insured, the insurance rate is 0.8 ‰.

International freight forwarders typically offer cargo owners services for cargo transportation insurance. International freight forwarders are able to purchase cargo transportation insurance on behalf of cargo owners, saving them the time-consuming task of doing it themselves. They can also provide professional advise and assistance.

In order to directly interact and bargain with insurance firms about insurance terms and payout requirements, cargo owners can also choose to purchase cargo transportation insurance directly from insurance companies. However, cargo owners must take on more risks and duties on their own compared to entrusting international freight forwarders to purchase insurance.

Entrustment The client shall fill in the insurance information form and provide the name of the insured, description of the goods, insured amount, purpose, ship information, etc.

Pre insurance According to the insurance company designated by the client, the agent shall issue an insurance pre insurance information form for the client to check the relevant information and confirm.

Generate formal policy After the confirmation of the client, the formal insurance policy and freight insurance will take effect, and the agent will issue the original insurance policy and mail it to the client.

Expense settlement The principal and the agent shall settle the insurance premium according to the insured amount shown in the insurance policy and the rate agreed in advance

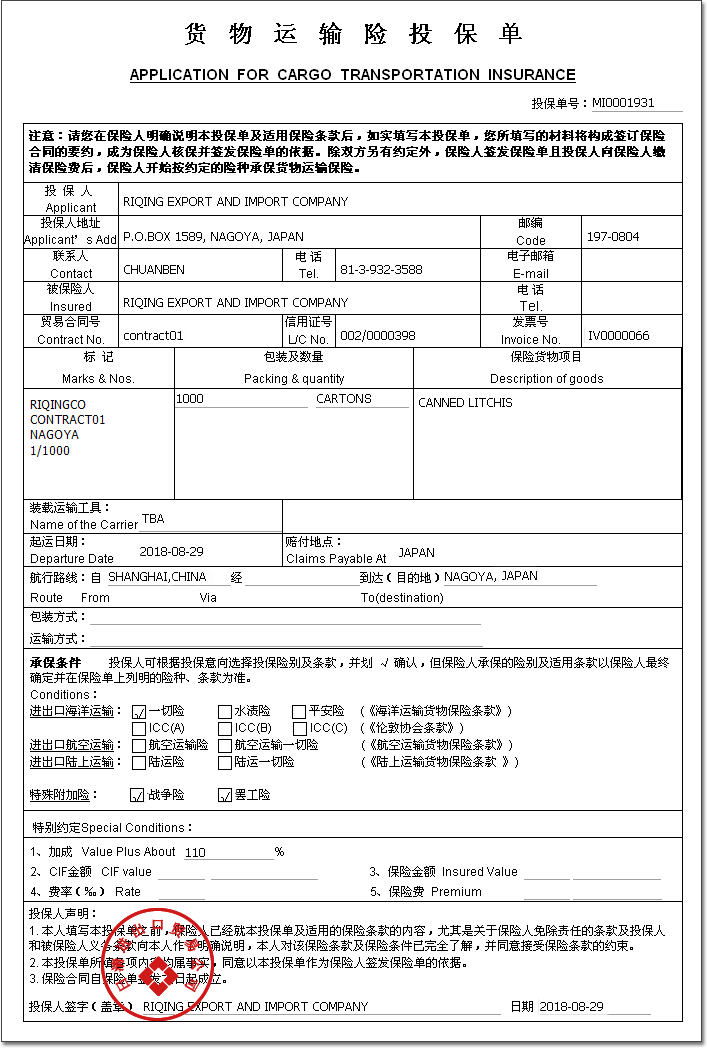

Sample cargo transportation insurance policy

Before purchasing international cargo transportation insurance, cargo owners should carefully check the quantity, quality, packaging and logo of the goods to ensure that the goods meet the transportation requirements in order to avoid difficulties in paying insurance claims due to the problems of the goods themselves.

When choosing an insurance company, cargo owners should choose those insurance companies with good reputation and strength to ensure that they can be paid in time when losses occur.

Before buying insurance, cargo owners should read the insurance terms and conditions carefully to understand the scope of insurance, premiums, deductibles, compensation standards, etc. If you have questions about the insurance terms, you should consult with the insurance company or international freight forwarder in time.

International cargo transportation insurance is one of the important insurances that cargo owners must purchase in the process of cargo transportation. The purchase of insurance not only lessens the risks and obligations for cargo owners during the transportation of cargo, but also ensures the safety and integrity of cargoes during the transportation process, giving them complete protection and assurance. To safeguard the security and integrity of the cargo during transportation and to lessen the risks and duties placed on the cargo owner, we advise you to buy the right insurance for cargo transportation.

We use third-party cookies in order to personalise your experience.

Read our cookie policy